Friday, July 31, 2009

Tuesday, July 28, 2009

Tick Size Weightage, should it be lower or higher ?

So as you may see, sometimes we want to tick size to be as small as possible, some other times we want the tick size to be larger than our transactional cost.

Monday, July 27, 2009

KLSE New Tick Size Impact

When you put both graph together, the current / old tick size vs the future / new ones, you get below graphs ...

When you put both graph together, the current / old tick size vs the future / new ones, you get below graphs ...1. Long term investors can now accumulate expensive stocks with much cheaper cost, especially those between RM 3 and RM 10.2. The only speculatable ground is now reduced to below RM 0.50 arena only.

A Short Break

So, the woman who made the 911 call which led to the arrest of Skip Gates – this is the neighbor at Harvard Magazine I wrote about – is denying she is a racist on account of her color. Her lawyer – no doubt retained to negotiate a book deal or a TV appearance – says that “the fact is, she’s olive-skinned and of Portuguese descent”. That is the same as being “tobacco colored”, in the less neutral phrasing of another American of Portuguese descent. “You wouldn’t look at her and say, necessarily, ‘Oh, there’s a white woman’. You might think she was Hispanic,” says the lawyer.

Personally, whenever I see a white woman pass by, I say to myself: ‘Oh, there’s a white woman.’ I also say, ‘Oh, there’s a black woman’, when I see a black woman pass by. Until recently, I also said to myself, ‘Oh, there’s a Chinese woman’ whenever I thought I saw a Chinese woman. But sometimes I got confused or had second thoughts: ‘Oh, maybe that was not a Chinese woman. Maybe that was a Korean woman.’ So now I lump together Chinese, Korean and Japanese women, together with Malaysian, Singaporean, Thai, Filipino, Burmese and Vietnamese women and throw in Sri Lankan and even Indian women for good measure and just say to myself, ‘Oh, there’s an Asian woman.’ That is what I do in post race America when I walk down 5th Avenue.

The caller’s lawyer categorically rejected that her client ever spoke to the arresting Officer Crowley, although that is precisely what Officer Crowley has written in his report. “She went on to tell me that she observed what appeared to be two black males with backpacks on the porch of Ware Street,” his report says.

So of the two main characters involved in Gates arrest, at least one is a liar. Or all three, if you count the lawyer. Of course, this is no Rashomon. We see through these characters as if looking at a glass menagerie.

Finally, the caller’s lawyer finishes with this gem: “All she reported was behavior, not the skin color.”

MLK’s dream is coming close to realization. Blacks are judged not by the color of their skin but the nature of their activities on their front porch. Now that is not the same as the “content of their character”, but patience.

At times like these, I pity the poor souls who do not live in the U.S.; to think how much entertainment – incessant, polymorphous and free entertainment – they miss.

Now I really must get back to work.

Sunday, July 26, 2009

update EPF nominees when any one of them dies

Info Sharing.

|

The Way Markets Work (in the age of speculative capital)

The paper went on to explain how high frequency trading works. You can read the full article here. But you don’t have to. In high frequency trading, large orders by the institutional traders are shown – “flashed” – to equally large trading houses a few milliseconds before they are made public. The trading houses then exploit this information by getting ahead of the market.

Flash trades are available to anyone for a fee, in the same manner that live price quotes are available to anyone for a fee. The rest have to live with the “delayed” prices. So pompous posturing of Schumer notwithstanding, there is nothing unusual or unethical about it, certainly not with the prevailing standards in capital markets. In fact, the concept is the evolution of the “day trading” that attracted quite a following in the early 1990s.

The destruction of capital that took place in the recent crisis eliminated the possibility of creating “equivalent positions”, so speculative capital has had to return to its roots of buying and selling the same security. That is what day traders did in the early 1990s, only now the size of capital must be much larger. Gone forever are the days where a few street smart kids with $50,000 in capital and their “level II” machines could earn a living. It is this wholesale nature of the markets that creates perception of “unfairness”. The real unfairness though, lies in the fact that some folks have money, others don’t.

The Times had the good sense to focus on buying. Intercepting a sell order from an institutional investor is trickier because it might – and probably would – run afoul of rules designed to prevent short sales. But I am sure no institution that has allocated billion of dollars to trading and has placed its machines next to NYSE computers – to minimize the distance traveled by electrical signals – would contemplate any improper conduct.

High frequency trading is the “natural” way markets operate in the age of speculative capital. Whether you have a problem with it or not, I suggest you get used to it.

One Thing I Know About the Systemic Rot

Godard’s way of fighting this condition is willfully corrupting the message, so that the extremity of the illogic would shock the audience and awaken them to what takes place around them.

I can see his point. Every one can see his point; just turn on the TV! There have been many studies about the control of media by a handful of organizations and the impact of such concentrations. A recent study on the influence of the Internet found that while blogs play an important role in the dissipation of the news, the agenda, what blogs discuss and write about, is set by the major news organizations. Viacom, Walt Disney, Bertelsmann, Time Warner, Vivendi and Murdach's News Corp decide virtually everything that you hear and read. After the agenda is thus set and the boundaries of discussion delineated, bloggers are left to yap to their heart’s content – within the already set boundaries. Yes, Godard does have a point.

But his response is nihilistic. It is the adult’s version of throwing a tantrum, which ultimately becomes a cop out. Frankly, I have no problem with the control of the news by a few. The reason for my insouciance? I know that no matter how partially and one-sidedly the agenda is set and how tightly the wording and the narrative of a text is controlled, a reader who is paying attention will always be able to see through the issues. That is because, to strip the matter into its elemental formulation, it is impossible to say something without revealing something about the objective reality outside us. That follows from the nature of words and discourse and is true even when there is a conscious effort to misrepresent. Hence Kissinger’s comment that no one could lie completely, and the philosopher’s observation that he learned politeness from the rude people. That was also the premise of the Hollywood movie The Usual Suspects .

So I comfortably, confidently and conveniently rely on the mainstream media for information. Needless to say, I do not stop there. Read, for example, the Destruction of Fannie Mae and Freddie Mac, which was 100 percent based on the mainstream media reports but showed something that no media outlet had ever mentioned – or ever will.

What, then, is my take on the main story of the past week about the arrest of Henry Louis Gates Jr. at his home by a uniformed member of the Cambridge Police Dept?

Let us set aside what we know about the role of authority, the kind of people who are drawn to it, the makeup of the police department in major cities of the U.S., the role that movies and TV cop shows play in shaping the conduct of police officers and the conditioning of citizens to accept that conduct, the right of citizens to live peacefully at their home (to the point of defending it with deadly force!), et, etc.

Why was Officer Crowley at Gates’ doorsteps?

Answer: Because someone had called reporting a possible break-in, no doubt by “two black men.” (The other man was the limo driver helping Gates to open the jammed lock.)

Q: Who was the caller?

A: A neighbor.

Q: Professor Gates’ house is Harvard property, given to Harvard employees only. Is it safe to assume that the neighbor was also a Harvard employee?

A: Yes, she was.

Q: The house given to Professor Gates must have been in an upscale neighborhood on account of his high position. Is it safe to assume that the neighbor had an equally high position? Surely, she could not have been a low ranking clerk, right?

A: No, she is not a low ranking clerk. In fact, she works at Harvard Magazine.

A neighbor who works at Harvard Magazine.

There you have it. Henry Louis Gates Jr.’s neighbor who works at Harvard Magazine – I would not be surprised if she had a PhD in social relations – does not recognize him in the broad daylight of a July afternoon. Never mind that she does not stop to say hello or chat or inquire about his trip to China, from which he had just returned after a grueling 16 hr flight. She absolutely does not recognize him. Consequently, naturally, the solid citizen that she is, she picks up the phone and reports a break-in.

That no one mentioned this point means that it was not considered worthy of mention by virtue of its ordinariness.

It is from this population that the arresting officer Crowley is recruited.

Everything you need to know about the significance of the story and the social background against which it took place is now at hand. From day one, then, you could have surmised – called, really – everything that unfolded, including the officer’s self-righteous rage for being criticized, the predictable defense of his act by police chiefs and radio talk shows, and even the President’s foray into the “controversy” and his subsequent backing off.

Had the event taken place in some Mississippi backwater town, the case would be dismissed as a stupid act of a county sheriff and the ignorance of the local populace. In short, it would have been the “bad apples” defense.

I never believed that Southern hillbillies are more ignorant than Massachusetts intellectuals. Furthermore, facts are not isolated events. What is real is rational. This problem certainly transcends locality, which is another way of saying that it is universal, i.e., system-wide.

By a long detour we have finally arrived at this blog’s main focus!

The most critical attribute of a systemic flaw – whether a systemic risk or a systemic rot – is its ordinariness which, by virtue of being ingrained within the “system”, renders it invisible to those inside the system. There is no uber regulator that can detect, much less prevent, a systemic collapse of the financial markets because the collapse is the end point of markets’ normal operations. That is a terrible fact, but that is the way things are, which is why despite constant urgings, I am not in a hurry to get out Vol. 4 to “capitalize” on the current crisis. We are merely in the beginning.

One question remains: How can one learn politeness from rude people without having a frame of reference, without knowing what is rude and what is polite? How would you detect the true part in the narrative of someone who is bent on telling complete lies?

I will take up these topics in Vols. 4 and 5 of Speculative Capital.

Friday, July 24, 2009

Malaysia KLSE Bursa REDUCE TICK SIZE

Table 1: Current and New Tick Sizes on Bursa Malaysia

| Securities Price | Current Tick Size | New Tick Size |

|---|---|---|

| Below RM1.00 | 0.5 sen(1/2 sen) | 0.5 sen (1/2 sen) |

| RM1.00 to RM2.99 | 1 sen | 1 sen |

| RM3.00 to RM4.99 | 2 sen | |

| RM5.00 to RM9.99 | 5 sen | |

| RM10.00 to RM24.99 | 10 sen | 2 sen |

| RM25.00 to RM99.98 | 25 sen | |

| RM100.00 and above | 50 sen | 10 sen |

Thursday, July 23, 2009

RM92 S Dali's talk on Career in Financial Markets

Finance is a big complicated topic, Personal Finance on the other hand is really simple where the dumpest guy on the world can easily get 'everything' he wants. The 2 topics are hugely different.

Time: 10am-1pm

Venue: Sime Darby Convention Center, Bukit Kiara, Sri Hartamas

Price: RM 92 pp

RM 80 pp when purchasing 4 or more tickets

Tickets sold by Ticketcharge: 03-2241-9999

http://www.ticketcharge.com.my/index.htm

Enquiry: 012-3239192

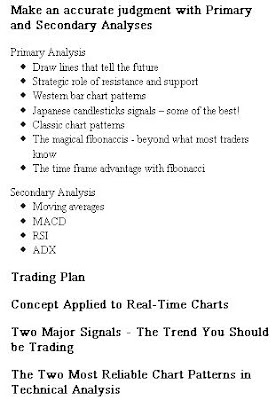

(click on image to enlarge)

Do you aim to be:

- a Fund Manager

- an Equity Analyst

- a Forex Trader

- a Private Equity player

- an Investment Banker

- a Corporate Finance executive

- an equity Dealer

- a Bond Trader

- a Hedge Fund analyst

The talk is by S Dali of Investing Scents weekly business column in The Star. He is an ex fund manager and head of research, for local and foreign investment houses, having worked in Sydney, HK, Tokyo, Singapore and KL.

Topics covered:

- the right degrees for the right careers

- ranked universities vs local universities vs second tier foreign universities

- specific subjects and majors

- is CFA the passport to success

- are you suited for the financial markets or do you just want to get rich quick

- getting through the front door, reworking your resume

- indirect passages to sound financial markets' careers

- what if your degree consisted of poor grades

- critical success factors to have for viable financial markets career

- remuneration scale for financial markets

- command of English, essential or unnecessary

- things financial markets employers look for

- is financial markets for you

- things they don't teach at business classes

Wednesday, July 22, 2009

Why does a Perfect Trading turn South ?

At first the Farmer can make 4 meats in 4 hours and 16 potatoes in another 4 hours. The Rancher can make 24 meats and 48 potatoes like wise.Then when they started trading, Farmer concentrates on making 32 potatoes in 8 hours while Rancher makes 18 meats in 6 hours and 12 potatoes in the rest of 2 hours. Farmer gives Rancher 15 potatoes, Rancher give Farmer 5 meats.After trading, Farmer has 5 meats and 17 potatoes vs previously 4 and 16. Now Farmer has more ! Rancher has 13 meats and 27 potatoes, Rancher has even more than Farmer's more!

Tuesday, July 21, 2009

Topics review 2009 July

a longer insurance series may follow soon after this mutual fund series ending in a few more articles.

Monday, July 20, 2009

How to passively choose a mutual fund

Are you sure you want to pay the extra fee just because they did good in the past ?Do you pay more just because you agree with the investment objective of the fund ?How about just because a certain fund has some of the stocks you want to buy anyway ?The agent is your friend, she did a great sale talk ?

Sometimes I like to shop in a particular grocery store more than another even if some items are slightly more expensive. That is because the store owner is really friendly and knowledgable. He can answer most of my questions and I really don't mind letting him earn the extra cents.

Thursday, July 16, 2009

Why so many hates & loves with mutual fund ?

- Fund managers are incompetent

- The only people who gest Rich are those agents, not the investors!

- mutual fund fee 5-6% are terribly HIGH!

- mutual fund returns are LOW!

- mutual fund is NOT a PASSIVE investment, you may as well buy stocks!

- Buy Low Sell High is applicable in mutual fund, why should I keep the fund knowing the price will drop?

- Mutual fund cannot be compared with FD, their risks are different!

- If you look at the world's best investors of all time, in average they out perform the market by 6.46%. This includes Warren Buffet, Benjamin etc. Most of the fund managers may not be as good as the Gurus, but their past historical performance is not that far apart.

Most people who curse at fund manager's competency are due to their unrealistic expectation. Some ofcourse is due to their own unhappy experience. Either ways, generally fund managers' performance is at par but definitely has room to improve. - Let's face some factual figures. The most a mutual fund business can squeeze out of the investors are the 5-6% no matter how they distribute among their agency force. Insurance can be up to 40% while MLM structure usually allocate more than 55% in similar distribution.

So if one is worry his agent gets richer just because he invest, mutual fund is probably NOT the first and major concern relatively. - The 5-6% High Fee is VALID but may not be as bad as it was described. For example, a comparable stock investment with 0.7% fee could have an effective rate of 2.31% vs the mutual fund's 5.5%. So buying one mutual fund is as if buying 2 stock counters.

- See 1). Get the expectation right. No one becomes rich because they buy mutual fund. But when done right, many retire wealtheir than they initially thought of.

- Yes, mutual fund CAN BE an active invesment like in 6). But MalPF preaches not to use it that way, one should use mutual fund the PASSIVE ways.

- If you know the timing of a market trend, mutual fund and dollar cost averaging concepts is NOT something for you. Buying a stock can give you exercise your timing concept with lower fee. This is an example of how to.

Are you sure you are not an agent earning commission when you encourage people to speculate using mutual fund ? Are you sure there is no conflict of interest with your clients portfolio ? - As mentioned above, the top part of mutual fund ie. equity fund cannot be compared with FD but the lower part of mutual fund ie. capital guarantee fund, money market fund etc. CAN.

OCBC uses Mortgage Lending Rate instead of BLR

But if you really put the numbers together, you may realize its just another looks-good but pratically almost everything stays the same. For example, the typical BLR in the market now is 5.5% and the common offer is BLR - 2.2% so

BLR 5.5% - 2.2% = 3.3%

MLR 4.7% - 1.3% = 3.4%

Wednesday, July 15, 2009

How Malaysian would die ?

Travelling : 2nd biggest personal finance killer ?

Tuesday, July 14, 2009

Getting Rich is NOT part of Personal Finance

Monday, July 13, 2009

On the Destruction of Capital

Capital is a social thing. It has no equivalent any more than art or religion has equivalents. Its destruction, likewise, is a very particular phenomenon. So it is nonsense to speak of the “equivalent of capital destruction”. What we have in this crisis is the destruction of capital, period.

Why did the authors of the report insert the word equivalent where it does not belong?

The answer is that it tones down what is being said. To the delicate ears (or eyes) of bureaucrats in Brussels, “destruction” would be too strong, so their minions diluted the word the best they could.

But surely these authors must know what capital destruction is, otherwise it would be impossible to speak of something “equivalent” to it.

The truth is that they do not. They merely have an inkling about it, the way Bernanke has an inkling about systemic risk. If pushed to explain exactly how capital is destroyed or what the “system” is in systemic risk, they would have nothing to add except reguritating what they have already said.

The pussyfooting and hesitant writing is the by-product of unclarity of thought. At the same time, it works to maintain the unclarity and, in doing so, creates a going concern of ignorance.

I have written about the destruction that is going on around us. See, for example, here and here and here.

When capital is destroyed, its various forms shrink. Speculative capital is hit particularly hard because of its reliance on leverage. Arbitrage opportunities turn exoskeletal and cannot be exploited quickly – or at all. That is the story behind the closing of Meriwether’s “relative value” fund. The man is no doubt a good trader but like all traders understands nothing about the real theory of finance.

How exactly is capital destroyed? What are the mechanics and dynamics of the destruction – and its consequences?

These are the main questions tackled in Vol. 4 of Speculative Capital. If you are interested in the subject, stay tuned.

Tuesday, July 7, 2009

A Curious Statement (worth pursuing further)

The story involved one Sergey Aleynikov, an ex-Goldman employee, who allegedly downloaded the firm’s proprietary trading software to his computer before leaving for greener pastures.

The story was jazzed up for maximum effect, with code words such as “sophisticated high-speed trading”, “a server based in Germany”, “a memory device” and, of course, “Sergey”! But it had too many holes in it and I didn’t buy it for a second. Apparently, neither did the judge, who released the said individual on a $750,000 bond.

If Sergey Aleynikov did what he is alleged to have done, he must have been a geek who learned nothing about finance while at Goldman. The superiority and, therefore, the value, of Goldman’s trading software does not come from some special insight into how markets work. It is, rather, due to the firm’s capital; Goldman could throw hundreds of millions of dollars into the market in order to create, and simultaneously profit, from an arbitrage position. The arbitrage opportunities are available at the wholesale level only. There is no opportunity in these markets for poverty-stricken geniuses. Fools with money will trump them every time.

What grabbed my attention, though, was the argument of the assistant United States attorney handling the case who told the federal judge that “Mr Aleynikov’s supposed theft posed a risk to United States financial markets”. He went on to add that “the bank” – that would be Goldman – “raised the possibility that there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways.”

That is a very curious statement. Now, if I were a systemic risk regulator, of the kind the Federal Reserve is soon to become under Obama administration’s proposals, I would approach Goldman and insist on getting answers to the following questions:

1. How and in what way could this program pose a danger to the U.S. financial markets?

2. How and when did you become aware of this potential danger of the program – at the planning stage, after it was coded, after it was put into use?

3. When and what were the circumstances in which you became aware of the potential danger of the software to the financial system?

4. What actions were taken after the potential danger to the financial markets was discovered? Who was the highest ranking officer to be informed of the potential threat?

5. What department was responsible for developing the program?

6. What department is responsible for maintaining the program?

7. Who wrote the technical specifications (the “specs”) for the program?

8. How long has the program been in use?

9. Who has used the program since it was put in production?

10. Is there a flag in the program that alerts the user to a “red line” beyond which the normal use would turn into a danger to the financial systems?

11. If Yes, explain how. What would happen if the red flag were ignored?

12. If No, how would the user know that he/she was crossing a red line?

13. Provide a detailed history of how Goldman used the program since it was installed.

14. Provide a detailed “what if” scenario of how someone bent on harming financial markets would have used the program since it was installed.

These are questions I would ask Goldman if I were a systemic risk regulator.

Finding Best Rates FD, BLR, House and Car Loan etc

Monday, July 6, 2009

A Rather Egregious Case of Confusing Cause and Effect

All those abstract issues were beautifully rendered in a real life and easily comprehensible example thanks to the research of Professor Mark Garmaise of UCLA’s business school. The Financial Times reported the results of the professor’s iconoclastic research in which he showed that “before crisis, US mortgage brokers fed loans of deteriorating quality to the banks they did most business with.” This, the professor concluded, proved that brokers abused the trust of the banks and in doing so, planted the seeds of the crisis which, everyone remembers, began in the subprime mortgage area:

”At the beginning of a relationship, the bank’s natural intuition is to avoid fly-by-night brokers they barely know,” said Professor Garmaise, who likened bank-broker dynamics to a marriage. “The broker knows this, so they are on their best behavior, but over time the broker gains credibility and each additional mortgage matters less.”That brokers initiated progressively lower quality mortgages is a matter of record. Very little by way of research is needed to confirm this well-documented race to the bottom. But just about everything else in the research is wrong. Far from being hapless victims, banks were the instigators of the problem. They pressured the brokers to keep the mortgage supply chain going no matter what the quality.

Such breached of trust accounted for a staggering 22 per cent of late mortgage payments and 28 per cent of foreclosures in the nearly five years covered by the study.

In the two-part series on the destruction of Fannie Mae and Freddie Mac I documented this pressure and explained the reasons for it. In Part 2, I quoted the following telling passage from a New York Times story:

[William D. Dallas, the founder of a mortgage brokerage] recalls being asked to make more “stated income” loans, in which lender do not verify the information provided by borrowers and brokers with tax returns, pay stubs or other documentations. The message, he said, was simple: You are leaving money on the table – do more of them.Rewriting history is a favorite sport among the powerful who stand exposed by the light of the past. (A Soviet era politician once quipped that “nothing is more unpredictable than the past.”)

That is where the role of true scholarship, i.e., disinterested scholarship, comes in: to filter the noise injected into past events by the self-serving spin of interested parties.

But there are no disinterested scholars in the U.S. universities. A finance professor in a major business school simply cannot function without constantly bringing in grant money. And when you take the king’s shilling, you play his tune. More: you dance to his tune.

This is the academic cadre that is expected to find a way out of the crisis.