It was mentioned before that you can use your EPF money to invest directly in the stock market, especially through Jupiter and Amara. The main selling points are;

- cheaper than invest to Mutual Fund ( 5.5% ) vs 3% charged by Amara

- freedom to invest in any particular stock and not a whole portfolio.

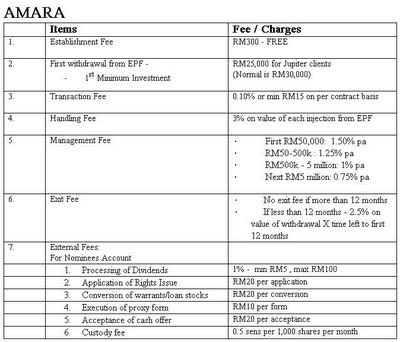

Although Jupiter only charges 0.1% or minimum RM 10 brokerage fee but actually Amara, the licensed EPF withdrawal facilitator, have more charges other than the 3% one time drawn down fee.

The significant ones are

- Transaction fee : 0.1% or minimum RM 15 per contract

- Custody fee RM 0.005 per 1,000 shares per month

Add together with Jupiter's fee, your total brokerage fee may effectively be at 0.2% or minimum RM 25. So each MOTS (Minimum Optimized Trading Size) is RM 12,500. With RM 25,000 you can only make 2 transactions.

Assuming you fully load all your investment in the market and average price per share is RM 1. Then 25,000 shares /1,000 x 0.5 cent = RM 0.125 every month. 1 year would be RM 1.50. That would be 0.006% of your initial RM 25,000 investment.

At the end, you may still be paying 4-5% fee in the whole process. In contrast to mutual fund's 5.5%. If saving fee is your main target, perhaps becoming a mutual fund agent yourself could end up saving more. On the other hands, most of the EPF oriented mutual funds are charging less fee.

So if EPF gets a 5% return, you should be able to do more than 10% in order to 'invest yourself'. Else you may just be depleting your ASS - Automatic Saving System.

Also be reminded that if you make a lot of transactions, you may end up paying more than 6% fee.